Raw data is found on the Google Sheets link at www.EverythingEven.com

The CEO.ca #StockPickingContest is a contest that I, Evenprime, have been running since 2016. It has increased exponentially each year, with 1,493 participants for 2020. The contest starts every year on January 1 when each user chooses 3 companies to create a portfolio that then gets averaged. Note that CEO.ca is not affiliated with this content, which is for entertainment purposes only. Please read the disclosure and disclaimer at the end of this article for more information.

In this article we discuss:

- Our new sponsor Scottsdale Mint

- Potential mug designs for 2019: Help us choose

- @PinkHappyButterfly is in first place by a land slide - his comments

- Comparing the contest with the S&P/TSX Venture Composite Index

- First Quarter Performance

- How your company share price compares to the other 1,029 in the contest

- Performance of the 20 most picked companies

- Sponsor Update (RJK Exploration, Fireweed Zinc, and Osprey Gold)

I have heard from multiple sources that people have been unable to purchase precious metals from their local dealers, as everyone is either out or short of supply. I reached out to Scottsdale Mint and confirmed they can fill/meet this demand as they are not only a dealer, but also a mint and can therefore mint new coins/bars as orders come in.. A few of the boys on here have dealt with them in the past and have excellent things to say, so we've picked them up as a site sponsor to help get their name out. So, if this is the beginning of the Apocalypse, don't worry, you now know where to shop!

Click here to shop at Scottsdale Mint

The top 50 contestants in last years' contest won a mug. We are down to the final two designs. Help us choose!

Vote for which mug design you like best.

Vote here: https://twitter.com/EvenPrime43/status/1247088840390529024

The harrowing numbers in the stock market over the last three months, notably the last 30 days have everyone completely rethinking their risk management portfolio. Personally, this Covid-19 pandemic has affected me in more ways than just my investment thesis. Unfortunately, I do not live with my wife, and last month, just after I attended PDAC, I got a light cold and developed a dry cough, which I still have today. I've only seen her twice (both times from a-far) and although we chat on the phone twice a day, it is hard to express how much I miss her. She sees her parents often so we can't take any risks. I've been in isolation for a month now.

As many of you know, I recently lost my job, my career, and in some ways, my identity. See my initial post when I was still in shock: https://ceo.ca/index?f6e0b81fb55f. I am a subcontractor, and 85% of my work is at the airport. With all projects currently cancelled I cannot see them re-opening any of them within the next year as the airline business will be heavily hit by this. So after all this passes, I'll be back to the drawing board trying to sort out which path I should take. This past month will be ingrained in our memories and the 'lessons learned' from our personal life, all the way through to the government's reaction will be forever talked about. There will be hundreds, if not thousands of books written about what we are suffering through right now, so pay close attention but remember, this will pass, and we will be okay.

Anyway, let's discuss the Stock Picking Contest's 1st Quarter Statistics!

*NOTE: Before I start, I noticed some incorrect prices coming from Yahoo Finance. I did my best to find and correct these.

Alarming Statistics:

- Out of 1,029 companies chosen in the contest, 887 of them are currently negative.

- Out of 1,493 contestants in the contest, 1,431 of them are currently negative.

- There are currently only 2 contestants in the contest who currently have all three picks in the positive.

Source: http://www.everythingeven.com/2020hattricks.php

The top 10 contestant portfolios look decent, but many of them have only one good company followed by two horrendous picks.

Source: http://www.everythingeven.com/2020spc.php

In first place we have @PinkHappyButterfly. I love his name especially considering the current situation we find ourselves in.

Notice his three picks are actually all short ETFs.

HOD.TO is the BetaPro Crude Oil -2x Daily Bear ETF

HUV.TO is the HorizonsBetaPro S&P500 VIX ST Fut ETF

HSD.TO is the Horizons BetaPro S&P 500 Bear Plus ETF

So what did he know that we missed? I laughed when @gustking shared this #index conversation dated Dec 18, 2020.

He is either very smart or really lucky, or a combination of both. I reached out to him and asked for his thoughts.

"Just like many other traders who anticipated a big pull back in Indices due to FED policies.

Vix who held the 14$ handle for a long time with all time high market got me suspicious.

Oil fallow the market as rule of thumbs and with the excess petroleum reserve, I knew that if I was right on $HSD I would have great chance of being profitable with $HOD.

The "house position" made available by ceo.ca is a great tool to trade those Horizon ETF. There are repetitive patterns that can help one to understand how they trade. Shares mostly exchange between 2 houses. One being the "bull" and the other the "bear" . Kinda like counting cards at the casino"

- PinkHappyButterfly

When he speaks of House Positions being available on CEO.ca, he is referring to a CEO Pro Subscription, which I also very much enjoy. As mentioned earlier, I am not affiliated with CEO.ca, and I am not paid by them in any way although I used to be a contracted site moderator back in 2017-2018. I just really like CEO PRO and often plot graphs looking for 'House Trends' in certain illiquid stocks.

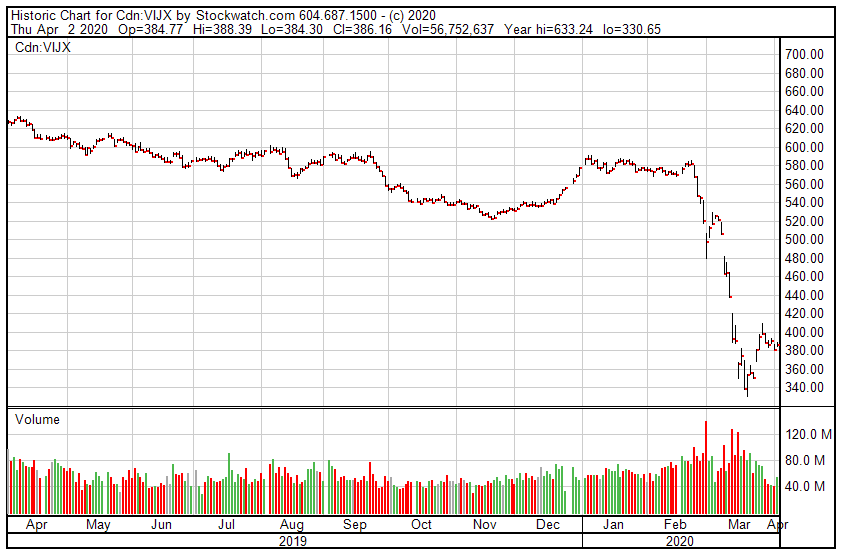

You'll notice the recent cliff in the chart below. That pretty much resembles everyone's trading account. Almost every other market chart in the world today has this same cliff. The S&P/TSX Venture Composite Index is probably one of the best indexes to juxtapose with the contest as ~70% of the companies we track are on the Venture Exchange.

But the Canadian junior investors world or should I say, the "venture capital world" has been in dire straits for as long as I can remember. I think 'newbies' often make the mistake that because the American markets have been steadily increasing since 2009, so too must be the riskier venture markets in Canada. This is definitely not the case, as evidenced by examining the 10-year chart. And trust me, the 20 year chart is no better.

So, where does this leave us? Well, before we blame everything on Covid-19, there is some evidence that things were falling apart before this. Below is a pie chart showing the portfolio performance of everyone in the contest as of Feb 27th (the Dow Jones had lost only ~7% and the mass panic had not really started).

Eighty-four percent of contestants (1,255 contestants) were in negative territory. But the worst was yet to come. Below shows the portfolio performance of everyone in the contest as of March 31, 2020.

But the argument is always, "this data is not a true image of people's investing strategy!" People choose these companies for fun, and many do not have real investments in them. I agree with this to some extent, so I also created the pie chart below that represents each company's performance over the first quarter.

I'd argue these companies are more often than not the more popular stocks in the venture markets and thus better represent the overall trends of the market. There are countless zombie companies lying dormant on the Venture Exchange that most likely did not change percentage at all because they are, well, 'nearly dead'. And this dead weight is what keeps the venture imaginably propped up. In other words, I think we all took a much harder beating in our real life venture market trading than the JIXJ index suggests.

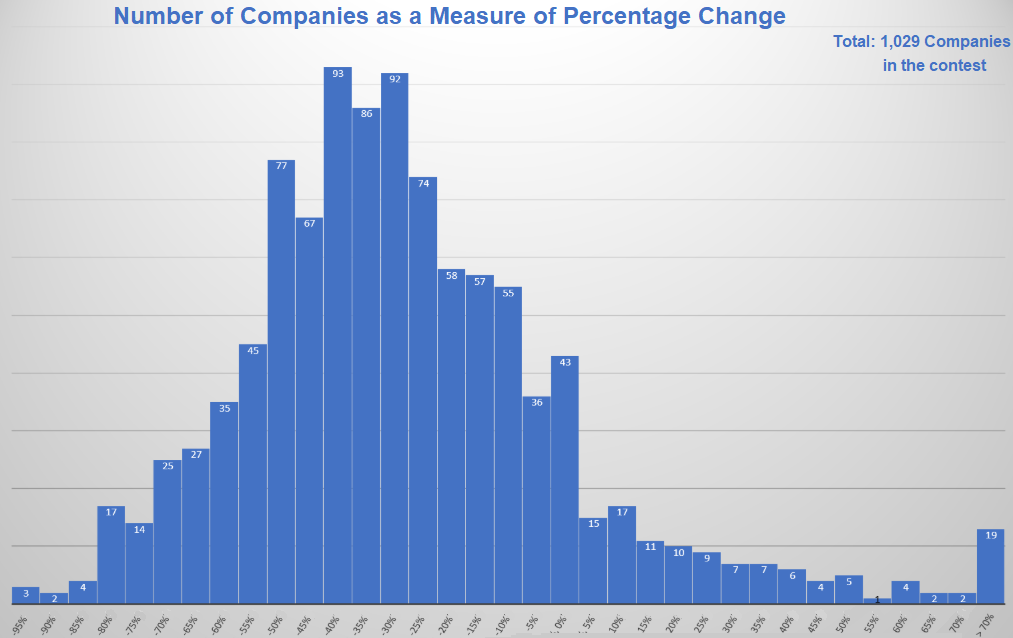

I have viewed over the last month at least twenty instances on CEO.ca where users complain on a company channel about the drop in share price as if is the company's fault. They say their stock is down 60% where as most other companies they follow are only down 30%. I understand the pain and frustration but we need some sort of metric to compare, so I wanted to provide some rudimentary statistics to show how this macro economic condition has affected all companies in the contest.

In the chart below, I binned together the companies that fall within a 5% range. Looking at the peak, you can see we have 93 companies in the -40% bin. This means 93 companies have lost between 40% and 45% on the year. The average loss is ~28% but the median is probably more accurate here at a ~33% loss. The standard deviation is 40%. You can arguably say that a company that has lost 28% + 40% = 68% has lost that due to macro economics and not directly because of the company. And that is with using only 1 standard deviation. Now, I haven't normalized this; hence, why the median is probably more accurate, and I probably would made some data experts cringe but I wanted to keep this as simple as possible and not manipulate the data to the point where the average person cannot understand it.

And now onto my favorite section: the most picked companies in the contest as of the end of the first quarter. Having read previous articles, you'll remember me joking about creating an EvenPrime's Short ETF that shorted these companies. Every month, I would be getting richer and richer!

For now, the trend remains the same. On average, the most picked companies in the Stock Picking Contest always seem to under perform expectations. This trend has yet to be broken since 2018, although I was tracking it yearly then, and now I track it monthly.

My investment thesis remains the same when examining the most picked companies in the contest. These companies are already exciting; people know about them, and the word is already out there. In my uneducated opinion, I think generally, these conditions are unfavorable for investing.

Now remember to take what I just said with a grain of salt. I am not an expert by any means, I do not work in the financial industry and I have no certifications that say I know what I am talking about. I can't even say what I jokingly used to say, "I'm just a slacker who works at the airport," as I just lost my job there lol but honestly, I'm just a guy with a degree in astrophysics and a couple diplomas in engineering, and I like looking for trends. I enjoy doing this because I believe there is real value in the numbers if you dig deep and that is why I am providing you with my Google Sheets data on my website.

And with 1,493 contestants, I think the sample size is large enough to draw some accurate conclusions. But remember there are a lot of biases in both the numbers and my thoughts. Be safe everyone and please stay home. Whether you believe in this virus being real or not, always err on the side of caution.

Sponsor Updates: We have great news!

RJK Exploration has found diamonds! Although they are tiny, this is a major milestone. Eighteen natural diamonds, varying in colour, have been recovered in a 22.4 kg (50 lb) drill core sample. The mini-bulk sample was processed by CF Mineral Research Ltd., a laboratory, owned by Dr. Charles E. Fipke. https://insidexploration.com/rjk-explorations-discovers-18-diamonds-from-a-22-4kg-50-lb-core-sample/

Fireweed Zinc's CEO, Brandon MacDonald gets asked all the tough questions by the Crux Investor and survives!

Osprey Gold Development Ltd. and MegumaGold Corp are pleased to announce that they have entered into a letter agreement pursuant to which MegumaGold will acquire 100% of the issued and outstanding shares of Osprey via a business combination. https://ceo.ca/@nasdaq/repeat-megumagold-and-osprey-gold-to-combine-creating

Disclosure: The author of this article owns RJK Exploration shares and may choose to buy or sell at any time without notice. Scottsdale Mint and RJK Exploration are currently site sponsors.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This article is intended for informational purposes only! All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek," "anticipate," "plan," "continue," "estimate," "expect," "may," "will," "project," "predict," "potential," "targeting," "intend," "could," "might," "should," "believe," and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report.

The author does not work for CEO.CA. The views expressed in this report are the personal views of the author and do not reflect those of CEO.CA. Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report. This article is intended for informational and entertainment purposes only.

Be advised, the author is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online report, including this one, especially if the investment involves a small, thinly-traded company that isn't well known.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this report or on this website.

The author shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this report. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but the author does not guarantee that they are accurate or complete. The author’s views and opinions in this report are his own views and are based on information that he has received, and assumed to be reliable. The author does not guarantee that the companies mentioned in this report will perform as he expects, and any comparisons made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this report.