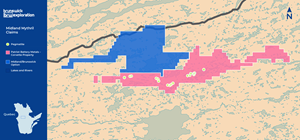

MONTREAL, Nov. 10, 2022 (GLOBE NEWSWIRE) -- Brunswick Exploration Inc. (TSX-V:BRW; “BRW” or the “Company”) is pleased to announce it has signed an option agreement with Midland Exploration (TSX-V: MD) to acquire a maximum 85% interest in potential LCT (lithium-cesium-tantalum) mineralization of the Mythril and Elrond properties (the “Properties”), located in the James Bay region of Quebec. The Mythril property is located immediately north of Patriot Battery Metal’s Corvette project in Quebec.

Mr. Killian Charles, President of BRW, commented: “We are very pleased to further expand our exploration holdings in Quebec’s James Bay region with this option agreement. The lithium acquisition option on the Mythril and Elrond properties are adjacent to Patriot Battery Metals’ outstanding Corvette project. This option agreement constitutes a significant addition to our extensive James Bay grassroots portfolio and we are excited to rapidly unlock its lithium potential in 2023.”

Midland Exploration Option Agreement

The Mythril and Elrond property package contains a total of 511 claims, representing 26,290 hectares. Both properties have never been explored for lithium. Prospecting will be prioritized in 2023 and may lead to trenching and drilling if results warrant it.

The First Option allows BRW to acquire an initial 50% interest in the rare mineral potential of the Properties (exclusive of base and precious metals) for a total consideration of $500,000 in cash and shares over a 3 year period, upon closing of the option agreement (the “Agreement”) under the following terms:

- An initial payment of $50,000, half of which is in shares, within five (5) business days of the Effective Date of the Agreement;

- A payment of $100,000, half of which is in shares, on or before the 1st year anniversary of the Effective Date of the Agreement;

- A payment of $140,000, half of which is in shares, on or before the 2nd year anniversary of the Effective Date of the Agreement;

- A payment of $210,000 in shares, on or before the 3rd year anniversary of the Effective Date of the Agreement;

In order to exercise the First Option; Brunswick Exploration shall fund an aggregate amount of $1,500,000 in Work Expenditures in accordance with the following schedule:

- A firm commitment of $300,000, on or before the 1st year anniversary of the Effective Date;

- An aggregate of $600,000, on or before the 2nd year anniversary of the Effective Date;

- An aggregate of $1,500,000, on or before the 3rd year anniversary of the Effective Date;

The Second Option allows BRW to acquire a further 35% interest in the Properties for a total consideration of $200,000 in cash or shares over a 2 year period upon exercise of the First Option under the following terms:

- An amount of $100,000 in cash, shares or a combination of both at BRW’s choosing on or before the 1st year anniversary of the exercise of the First Option

- An amount of $100,000 in cash, shares or a combination of both at BRW’s choosing on or before the 2nd year anniversary of the exercise of the First Option

In order to exercise the Second Option; Brunswick Exploration shall fund an aggregate amount of $2,000,000 in Work Expenditures in accordance with the following schedule:

- An aggregate of $1,000,000, on or before the 1st year anniversary of the exercise of the First Option

- An aggregate of $1,000,000, on or before the 2nd year anniversary of the exercise of the First Option

Upon execution of the Second Option, BRW will retain a right of first refusal on Midland Exploration’s 15% ownership. Furthermore, Midland will not be expected to fund its pro-rata of the exploration budget following the exercise of the Second Option until construction of a mine.

Corporate Update

The Company has entered into a debt settlement agreement with Robert Wares, director and officer of the Company (the "Debt Settlement"), to settle a $333,333 outstanding payment due in November 2022 on a convertible debenture issued in 2018 and which matured in September 2021, by issuing 952,380 common shares of BRW at a deemed issue price of $0.35 per Common Share. This Debt Settlement will be executed in shares in order to preserve capital available to the Company.

The issuance of the common shares pursuant to the Debt Settlement is subject to approval from the TSX Venture Exchange (the “TSX-V”). The common shares issued pursuant to the Debt Settlement are subject to a statutory hold period of four months and one day from the date of issuance of the Common Shares in accordance with applicable securities laws.

After the Debt Settlement, Robert Wares will own 44,235,572 common shares and 1,300,000 options of the Corporation, representing 27.4% of the outstanding common shares of the Company on an undiluted basis and 28.0% of the outstanding common shares on a partially diluted basis, assuming full exercise of the options.

The Debt Settlement will constitute a "related party transaction" within the meaning of the TSX-V Policy 5.9 (the "Policy") and Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") adopted in the Policy. The Corporation intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value (as determined under MI 61-101) of the Debt Settlement does not exceed 25% of the Corporation's market capitalization (as determined under MI 61-101).

Finally, the Company wishes to announce that it has engaged Olivier Tielens to assist the management team and board in corporate development matters on a 1-year consultation basis. BRW will grant 400,000 incentive stock options to the consultant. The grant is subject to a three-year vesting period and a five-year term at an exercise price of $0.32. The stock options have been granted pursuant to the Company’s Stock Option Plan and are subject to applicable securities laws and TSX Venture Exchange policies.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Mr. Jeff Hussey, Director of Brunswick Exploration. He is a Professional Geologist registered in Quebec.

About Brunswick Exploration

Brunswick Exploration is a Montreal-based mineral exploration company listed on the TSX-V under symbol BRW. The Company is focused on grassroots exploration for lithium in Eastern Canada, a critical metal necessary to global decarbonization and energy transition. The company is rapidly advancing the most extensive grassroots lithium property portfolio in Eastern Canada with holdings in Quebec, Ontario, New Brunswick and Newfoundland.

Investor Relations/information

Mr. Killian Charles, President (info@BRWexplo.com)

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Cautionary Statement on Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Corporation’s public documents filed on SEDAR at www.sedar.com. Although the Corporation believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Corporation disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3121b8a9-a3ec-4f97-89ee-c101e7248db1