Last week, I had the opportunity to have an hour long conversation with someone who I've known of for many years, but it was our first face-to-face conversation and it happened in cyberspace. Harry Pokrandt was the founding CEO of HIVE Blockchain, the first publicly traded Canadian cryptocurrency miner. Before his HIVE days, Pokrandt was managing director at Macquarie Capital Markets and a floor broker on the floor of the old Vancouver Stock Exchange in the 1980s.

Goldfinger

It’s great to speak with you today, Harry. We have a mutual friend in common, Tommy Humphreys. I told Tommy that you followed me on Twitter, and he began singing your praises. Tommy tells me that you used to be a broker on the floor of the Vancouver Stock Exchange. Is that true?

Harry Pokrandt

Oh, wow, those were the days. Back in 1984, I kicked off my career. Started out as a phone clerk on the floor of the Vancouver Stock Exchange. Doesn’t sound like much but it was close to the center of activity. Eventually, I moved up stairs and became a desk trader at Yorkton Securities. That's where the real adventure began. Spent some solid years on the trade desk and then jumped into the natural resource group within Yorkton, a venture that Frank Giustra set in motion. After that, I took a turn into institutional sales, wore that hat for a while. Packed my bags and moved to Toronto, where I called home for a good 15 years. Worked on the institutional desk there, soaking in the big city life. Good times, good times.

Towards the end of my Toronto stint, I made a shift into corporate finance. That's when Yorkton underwent a transition and became Orion Securities. The split was interesting – the retail part became First Associates, while the institutional side became Orion Securities. Eventually, Orion Securities was bought by Macquarie. I stayed on for a good 8-10 years, somewhere in that ballpark.

After 15 years of the Toronto hustle, my wife and the family decided to head back to Vancouver. Back to the roots, you know? I took on the role of Managing Director at Macquarie Capital Markets in Vancouver for around eight years or so. It was a great gig. But, as they say, all good things must come to an end. So, I eventually parted ways with Macquarie.

And after my stint with Macquarie, I've worn the director hat for quite a few public companies. Like you mentioned, I had the honor of being the founding CEO of Hive. It was a wild ride, spent a bit over a year there, and during my time, we took it public and managed to raise around $200 million. Hive was quite the story, the perfect storm, you could say. We were the pioneers, the first cryptocurrency miner to go public. Now, that came with its fair share of challenges. Cryptocurrency mining wasn't exactly a widely understood business at the time, so navigating the process of taking it public had its hurdles.

Following Macquarie, I was a director at Lithium X, Fiore Gold, and Gold X. Each of these companies were involved in corporate transactions.

After my Hive days, I stepped into the role of Chairman at Mayfair Gold, and currently, I'm also serving as a director at Vizsla Silver.

And I've got some private ventures that I'm involved with as well, one notable project is Spectrum Energy, where I wear the hat of Chairman. We're on a mission to retrofit a particle board plant down in Georgia, turning it into a wood pellet facility. It's an exciting venture with its own set of challenges and triumphs. So, that's a quick snapshot of the diverse bio – a lot on the plate, but that's what keeps things interesting.

Harry Pokrandt enjoying a Cuban cigar

Goldfinger

Let's go back to the Vancouver Stock Exchange. You know, if you go to Vancouver today, you walk along Howe Street, you'll see that the old Vancouver Stock Exchange building is now a hotel. And then there's a bank branch, I think it's National Bank on the first floor. How has the Vancouver market? I mean, it's funny because it's called the Venture now the Venture Exchange used to be the Vancouver Exchange, but it has always been a market for venture capital. And there's a lot of stories from back in the days when there was really the Wild West. How has the Vancouver market changed and what would you say is timeless?

Harry Pokrandt

Certainly, over the years, the financial landscape in Vancouver has undergone a significant evolution, becoming more sophisticated. This transformation is not surprising, considering the increasing importance of aspects like reporting, regulatory compliance, and overall confidence in off-market dealings. Building and maintaining trust has become a crucial aspect, necessitating constant management and improvement.

What's particularly fascinating is how Vancouver, especially in the realm of mining (and to some extent, oil and gas), has carved out its niche. It's essentially a hub for mining finance, whereas Calgary would lean more towards the oil and gas sector. Evaluating and assigning value to these resource companies is a unique skill set. Vancouver and, on a broader scale, Canada, bring a distinctive qualification to the table. Our long history in mining exploration, company building, and creating value from natural resources sets us apart globally. It's a skill honed over many years, and Canadians are renowned for their ability to explore, finance, and develop these companies into major players.

This ability to attribute value to something that might not align with conventional financial analyses is what sets Vancouver and Canada apart – it’s the combination of talented explorers and mine builders and the underwriters and the buy-side clients which doesn’t exist in many places.

Goldfinger

You make a good point that the Venture Exchange resides in Vancouver for a reason. And if you actually understand the history of the city, how it was founded and how it's evolved to where it is today, you know that it was founded on venture capital. It was founded on taking risk, going west, finding gold in rivers and streams, gold rush after gold rush. The city has a deep history of taking risks and exploring for resources. The province of British Columbia is abundant in natural resources, and Mother Nature has definitely kissed this place. So it absolutely makes perfect sense.

And these companies, as you point out, they're challenging to value because they do not have the typical financial metrics that a company like Microsoft or Chevron has where you can just simply put a multiple on earnings or revenues, pre-revenue companies are a speculation on some terminal value far out in the future. In particular, the junior mining sector is one that is particularly vulnerable to the ebbs and flows of investor sentiment and the wild swings that occur month to month, year to year, throughout market cycles. I would think that what is timeless about the Vancouver exchange or the Venture exchange, are these cycles and the human sentiment swings that drive the fund flows in the sector.

Harry Pokrandt

Oh yeah, sure. It's interesting. The longer it takes to build a mine from discovery to actual cash flow for copper mines, it might be well over a decade. For gold as well -- it's probably a bit shorter than a copper mine. But still from discovery to getting cash flow out of the mine -- if it's longer than the cycle of the metal, then somebody by definition has to lose money because you're going to live through a down part of the cycle. And these companies have to finance themselves. They must finance themselves along the way. So, if the development time is longer than the metal cycle, then somebody has to lose money along the way, unfortunately. So, it's a tough game, not for the faint of heart.

Goldfinger

No, it's not for the faint of heart at all. Do you have a favorite story or two from the Vancouver exchange days of the 1980s? I mean, is there something that pops into your head like oh yeah, this is a great story.

Harry Pokrandt

Oh, absolutely. Back in the day, the whole Casa Berardi area was buzzing with excitement due to a significant discovery, and Bruce McDonald was the promoter with a bunch of companies in that zone. Now, what added a humorous twist was that all his companies had names like Golden Knight, Golden This, Golden That. The floor of the exchange was organized alphabetically, and the traders handling the 'g's were in a constant whirlwind, crazy busy, and under high stress. It was a sight to behold, this tight-knit group dealing with the 'g' companies. The traders in the ‘g’s’ would loose their voices by the end of the trading day.

Back then, trading involved yelling at board markers and manually changing quotes on the wall. The traders had this incredible knack for recognizing voices without even turning around. The efficiency of the auction process was truly remarkable—it was like watching market magic unfold. Sadly, with the advent of automated and computerized trading, we've lost that raw, unfiltered feel of how auction markets used to operate. Trading was very labor intensive.

Despite the stress and tension, it was a fun time. Imagine 200 guys, mostly in their 20s, working hard in a bustling market. After wrapping up at 1:30 in the afternoon, they'd hit the pub, swap trading stories, and revel in camaraderie. By the time your friends outside of the business would show up after their work around 5pm you would be two sheets to wind. Go home by 8pm – early to bed to get up at 4:30 to be in the office by 5:30am to do it again. It was competitive and intense -- it was fun, but sadly, those days are gone, never to be relived.

Goldfinger

Yeah, I can only imagine what it was like back in those days. It's obviously similar to the futures pits in Chicago in terms of the setup and the physical dynamics involved in it. And yeah, we'll never have that again. It's sad, but it's also just human progress. Everything is faster.

Harry Pokrandt

Oh, for sure. I recall a day when we set a record for volume on the exchange, hitting 23 million shares for the Vancouver Stock Exchange. The sheer labor intensity to achieve that was insane. You had desk traders, phone clerks, runners shuttling tickets, traders reporting back fills, board markers, and folks updating quotes. It was a symphony of activity, but it was incredibly inefficient compared to today's standards. What happens in trading today makes the physical trading floor seem like a relic of the past, and it's not something we'd go back to.

Goldfinger

Yes. I do want to talk about some of your favorite investments right now, but first let's talk about Hive Blockchain and how you became CEO of HIVE Blockchain (TSX-V:HIVE) and what it was like to be the CEO at a time when Bitcoin, Ethereum and the rest of the crypto sector were having their first really widespread recognition from investors. At one point at the end of 2017, Bitcoin reached mainstream media recognition and there was an absolute frenzy on the run to almost $20,000. I guess the first question is how did you become CEO of HIVE and what was it like there at the end of 2017?

Harry Pokrandt

Certainly. While I was still at Macquarie, I found myself exploring the realm of Bitcoin. I purchased my first Bitcoin at around $100 and delved into understanding the mining aspect, which, back then, involved people mining on their laptops or desktop computers. The emergence of ASIC chips marked the early days of more efficient mining.

During this period, I encountered engineers from Sierra Wireless interested in miniaturizing ASIC chips for improved efficiency. Their goal was to raise $10 million for this endeavor. Intrigued by the concept, I developed a business plan around it. Payback on the funds would be less than a year. However, finding interest and raising funds for something as novel as Bitcoin mining proved challenging in those early days.

Fast forward a couple of years after leaving Macquarie, I learned that a group, including Frank Giustra, was exploring cryptocurrency mining. Given my prior interest and knowledge in the field, I joined them on a tour of a data facility in Iceland. Initially, we were seeking a young crypto-savvy CEO, but none we encountered had sufficient capital markets experience. Eventually, I took on the role with the understanding that it would be temporary until we found the right candidate.

As Hive went public, the cryptocurrency market, led by Ethereum, started gaining momentum. Ethereum, trading around $40 at the outset, surged to $200 by the time of our IPO. The confluence of events created a perfect storm—cryptocurrency was on the rise, Hive went public as the first cryptocurrency miner, and the business became highly profitable. Investors seeking exposure to cryptocurrency, without a direct avenue, turned to Hive, making us a proxy for the underlying crypto assets.

Goldfinger

Yeah, so let me just pause you for a second there. So I was an early shareholder in Hive, and I remember that time very well. October/November 2017. It was a heady time. And I remember when Tommy told me he was going to Iceland to look at this crypto mining operation, and he mentioned Ethereum. That was in April or May. I didn't know what Ethereum was. I spent a day researching and trying to understand it, and I immediately put $1,000 into Ethereum. I bought roughly twenty Ethereum at like $47 each. And that was me getting my feet wet in the crypto sector for the very first time. And I remember that I think it was late October. Those first Ethereum purchases quickly went up 10x. So my $1,000 was $10,000, and I sold. And then I missed the run to over $1,000.

But still, it was a hell of a trade. And it's just funny to look back on that, how good of an opportunity that was, because nobody really knew what Ethereum was in April 2017. It was very far under the radar, but it was starting to gradually gain adoption. And the way that it went viral over the next eight, nine months was really remarkable and a real example of what can happen in financial markets when you get in early ahead of the herd. And then the herd catches on, and it evolves into a speculative bubble. HIVE followed the Ethereum price fairly close, and I think the first financing was at $0.30, and it was also a 10x in a few months. Just a tremendous vehicle of wealth generation for early investors.

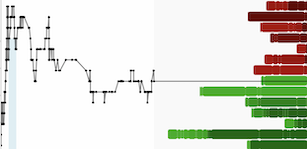

HIVE.V (Daily - 2017)

HIVE did a 1 for 5 share consolidation in May 2022 - that means that $34 on the chart above equates to roughly a $6.80 share price peak in November 2017

Harry Pokrandt

Yes, it was a perfect storm of events. Look, when we started the process to go public, I mean, the crypto market was not hot. We expected to do well, of course, but I don't think anybody expected what we saw.

The market response was incredible. From our IPO in September to December, we successfully raised C$200 million over several months, involving three or four financings. This period also saw us making strategic acquisitions, expanding our data centers, and acquiring assets in northern Sweden. It was a whirlwind experience, to say the least.

Goldfinger

Yeah. You guys set a record. That C$100 million financing. I think that was a record for the venture exchange at that time.

Harry Pokrandt

I don't know. It could have been.

Goldfinger

Yeah, it was pretty impressive. HIVE's growth was rapid, but investor expectations rose even more rapidly! I guess my next question is, how tough was it? Let's say when it was $3 a share, and suddenly you have a $600-$700 million market cap. Obviously, the animal spirits were running wild, and the expectations got very far flung, and far removed from reality. How was it being a CEO when you have this market just in a frenzy, and you're trying to tell the story in an honest way?

Harry Pokrandt

Oh, I remember that period vividly. We faced a unique situation with the stock during one of our financings, priced around $2.90, I believe. And we had raised a big chunk of money. I think that could have been the $100 million financing. After we closed the financing there was a significant short squeeze due to a substantial short position, and those who were short couldn't deliver shares. This forced buy-ins, mechanically impacting the stock settlement. The result? The stock shot up to around $6 in a matter of days. The buy-ins were forcing the stock higher and higher, creating an unsustainable situation. The share price was not up on fundamental reasons but rather on a short-term mechanical settlement problem.

It was a tough spot for us. We had voluntary pooling arrangements in place to restrict stock sales until certain dates. Recognizing the need to intervene, we approached regulators, the exchange, IIROC, and our underwriters, expressing the necessity to calm the market down. In response, they all agreed, and we announced an earlier release of those shares, not immediate but only a week ahead of scheduled release. This move helped calm the market.

The unfortunate aspect was that the price had become detached from reality, and it was clear that such levels were not sustainable. The situation got a bit out of hand, and it was a challenging time to manage expectations and market dynamics.

Goldfinger

Yeah, I think the actual high, if I'm not mistaken, was $6.75 a share. So that was more than a $1 billion market cap at the high. And this was for a company that was just early revenue and still many quarters from profitability, you were still building out the foundation of the business. So a billion dollar valuation for a company that's at such an early stage is definitely very optimistic. And the short squeeze and the whole frenzy for Bitcoin and Ethereum at the time helps to explain it. But it's very interesting that what actually ended up driving it so high was the short squeeze. A lot of people don't realize that.

Harry Pokrandt

Absolutely. Having a company's value skyrocket like that might be thrilling for traders, but for building a business and establishing credibility in the market, those massive spikes aren't the best for long-term sustainability. It's a tricky balance when things take off like that.

Goldfinger

A year or so later you stepped down as CEO, and Frank Holmes took over. I believe he’s still the chairman.

Harry Pokrandt

Exactly, Frank was the chairman before, and when I left, he stepped in as the interim CEO. Right now, Aydan Kilic is the CEO, and they're steering the ship well. They've got some interesting plans to shift part of the business a bit towards HPC computing—high-performance computing. They're diving into rendering for animation, special effects, and also into AI. This new venture brings in revenue that's not tied to cryptocurrency, providing a more stable income stream.

The cool thing about HPC is that the equipment used for rendering in the film industry operates in batches, not continuous work. During downtime, when it's not in use for high-performance computing, they can repurpose the GPU-type equipment for Crypto mining. While it's not mining bitcoin or Ethereum (since it's no longer proof of work), there are other cryptocurrencies they can mine when the equipment is idle. The main focus, though, is the potentially significant revenue from high-performance computing.

In this arena, they're competing with giants like AWS, but their advantage lies in offering more affordable pricing. Unlike some applications that demand triple redundant data centers, HPC computing doesn't, making their services more cost-effective than major players like Amazon.

On a personal note, Hive was a significant chapter in my life, and I have a lot of love for it. But to be honest, my current focus is more on mining and this pellet project. At the moment, the crypto world isn't my main gig. Throughout my career, I've been deeply rooted in the resource space.

Goldfinger

So I understand that you're an investor now, and you've been an investor for quite some time, is that right?

Harry Pokrandt

Yeah, throughout my whole career, I've also invested in things that I like, so I put sort of my money where my mouth is on things.

Goldfinger

Who are your favorite CEOs in the junior mining sector today and what makes a great CEO in this sector?

Harry Pokrandt

Sure thing. Among the companies I'm involved with, Patrick Evans leads Mayfair Gold (TSX-V:MFG), and Mike Konnert is at the helm of Vizsla Silver (TSX-V:VZLA, NYSE:VZLA). Both are exceptional leaders. Mike, despite his youth, has built an impressive team at Vizsla, making significant high-grade silver discoveries. He's a great manager of people. On the other hand, Patrick oversees a smaller team at Mayfair, and his strength lies in being straightforward and not overly promotional. His track record of advancing and selling companies, like Weda Bay and involvement with Dominion Diamonds, Mountain Province, instills confidence in what he says and delivers.

MFG.V (One Year)

Managing companies and investor expectations is an art, and these CEOs have different styles. Patrick, with his veteran status, holds credibility with institutional investors, while Mike had to earn respect and transition Vizsla to more institutional ownership. Adapting communication styles for different audiences, especially in front of sophisticated institutional investors, is crucial.

Looking at other people, John Robbins stands out for his knack in early-stage exploration companies. He has a talent for spotting value in the rocks and making significant bets on promising ventures. I was at a lunch recently with the Lundins, who, under Lucas's legacy, are doing a commendable job with projects like Filo and NGEX down in Chile. Their efforts are shaping a major mining district, promising wealth creation for many.

The discoveries in Chile are indeed remarkable and set the stage for a significant mining district.

Goldfinger

So speaking of the resource space here, we are winding down 2023. Overall it's been a pretty dreadful year for the junior mining sector. It's always tax loss silly season around this time of year. Can you think of maybe one stock that you bought in 2023 and that you really like right here, right now? I don’t want to put you on the spot, but I think a lot of readers would be interested in this topic.

Harry Pokrandt

No problem at all. Talking my own book, Mayfair Gold and Vizsla should perform well, even though Vizsla’s share price could be better. However, I have immense confidence in its potential, and I think it will be a standout performer over the next year. It's currently one of the highest-grade silver projects around, and I envision it following a trajectory similar to SilverCrest (TSX:SIL, NYSE:SILV).

VZLA.V (One Year)

Yesterday, I saw the Lundin team talk about NGEx (TSX-V:NGEX), a high-grade copper discovery. With the South American drilling season kicking in for Chile, NGEx and Filo are poised to attract significant attention. Another project that excites me is Snowline Gold (TSX-V:SGD). I visited Snowline’s Rogue Project in the Yukon back in September, it's clear that this discovery is a game-changer. While we're in a quieter drilling period right now, I think it gain momentum in the new year and emerging as a strong performer. I should have mentioned Scott Berdahl – Snowline’s CEO when we were talking about standout CEO’s .

Goldfinger

You have good taste when it comes to stocks, Harry. I would not be surprised if Snowline gets acquired next year. I agree that Vizsla is very impressive. I think the overall junior mining sector headwinds have hurt them because they've been pretty aggressive in advancing that project. Vizsla has been aggressively advancing Panuco, I think they have ten drill rigs at the project. In order to do that a company has to raise capital aggressively, and in this rising rate environment it's tough. I think Vizsla has something that's pretty extraordinary in terms of size and grade on their hands. Panuco is a classic Mexican silver vein field that just seems to be getting bigger and better over time. So yeah, $30 silver could really do great things for Vizsla shares.

Harry Pokrandt

Absolutely, a rise to $30 silver is a game-changer for all silver companies.

Now, a critical factor I've often emphasized in the junior mining space—one that often gets overlooked—is the risk of dilution. It's potentially a more significant risk than even the geological challenges. The key question is, how much money needs to be raised to achieve the anticipated value, and what level of dilution are investors facing in the process? The risk of dilution is more often a bigger risk than geology.

It's a delicate trade-off, and this aspect concerns me about many junior companies. Some are driven to keep their projects alive at any cost, disregarding the impact on shareholders and the dilution incurred, ultimately failing to create accretive value. It's crucial for companies to strike a balance and consider the long-term interests of their investors.

Now, on a positive note, another company I'm quite bullish on is Heliostar. Charles Funk, the CEO, is a young and dynamic leader. Another one I should have mentioned earlier. Having been involved in the early days of Vizsla Silver, he now heads Heliostar. The company has taken a unique approach to the Ana Paula High-grade gold project in Mexico, looking at it as a smaller very high-grade underground mine rather than the conventional open-pit scenario. It’s currently permitted as an open pit mine, so hopefully changing the permit to an underground mine should not be difficult. Looking at as a smaller but exceptionally high-grade underground project that should be relatively low cost to bring into production. Charles's strategic vision of the project could get it into production very quickly. Heliostar is cheap right now. I anticipate great things from them in the coming year, making it another favorite of mine.

Goldfinger

Yeah, I think that's a great place to leave it. I think that Heliostar announced they're going to be having a webinar next Tuesday, so that'll be interesting. I wonder if that is the announcement of the updated resource there (UPDATE: Heliostar Metals Announces Updated Mineral Resource Estimate for the Ana Paula Project, Mexico). That could be a very big day for the company.

Harry Pokrandt

Indeed, it could be a pivotal moment. While I'm not sure about the specifics, Charles has mentioned an upcoming resource announcement. Additionally, he rolled out an early exercise incentive program for warrants. A great strategic move to address the common challenge of an overhang of warrants. By encouraging early warrant exercises, it not only raises capital but also reduces the overall outstanding warrants. Charles is offering a third of a warrant at a higher price, providing the stock with room to breathe instead of facing a massive wall of warrants all at once.

Goldfinger

Thank you for this conversation, Harry. I feel like we could speak for hours, so we should probably do this again sometime in the new year.

Harry Pokrandt

It’s been a pleasure.

Disclosure: Author owns shares of Heliostar Metals at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Heliostar Metals Ltd.

DISCLAIMER: The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

The author of this article is not a registered investment advisor and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions. This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.