Thursday afternoon, gold rallied as high as $1812 as the timeless store of value works on its 3rd consecutive weekly gain:

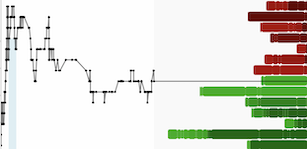

Gold (Weekly - One Year)

I have drawn a light green shaded area on the above chart to highlight my upside objective for the current oversold rebound rally in gold. There is a great deal of confluence in the gold chart between $1835 and $1850, and it's difficult to envision how we will quickly vault through this area of resistance.

The most bullish scenario could see gold consolidate in the low $1800s for a couple weeks, before embarking on its next leg higher in late August. Perhaps the most interesting aspect of gold's recent $130/oz rally from the July 21st low of $1678 is the lack of retail participation as evidenced by little interest by small speculators in gold futures.

Furthermore, Tom McClellan has pointed out that the Gold ETFs (GLD and IAU) are not seeing any interest from "the crowd" despite gold's recent rally:

"We have seen this happen before, when gold prices would turn higher but the total combined assets in GLD and IAU would refuse to turn upward along with prices. In those cases, what usually would happen was a longer up move in gold prices, an upturn which lasted until “the crowd” finally decided to get on board. The longer that they hold off from buying into these ETFs, the longer that the uptrend can last." ~ The McClellan Market Report

Finally, I found it notable that Equinox Gold (NYSE: EQX) managed to trade essentially unchanged during yesterday's trading session despite reporting weak earnings results that included a $78.7 million net loss for Q2 2022.

EQX (Daily)

Stocks/sectors bottom when they stop going down on bad news.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.