Recorded on March 18th, 2021 and shared with Junior Stock Review Premium readers first.

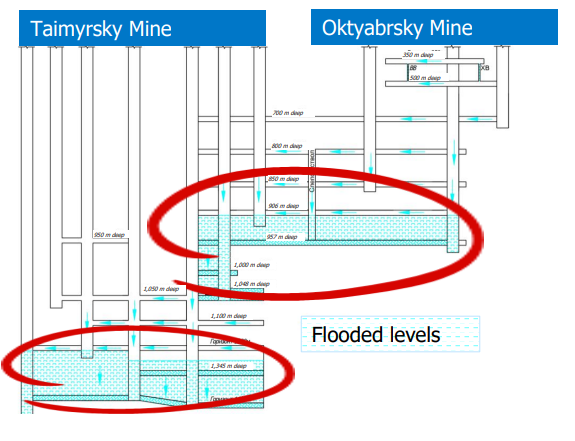

In Feburary, Nornickel announced that during tunneling operations, natural ground water inflow was detected at the 350m depth mark in the mine headwall at the Oktyabrsky mine.

Operations at both Oktyabrsky and adjoining Taimyrsky mines were suspended.

On March 16th, Nornickel updated the market on the situation and announced that operations aren’t expected to recommence for 3 to 4 months.

Given the loss of production, Nornickel confirmed that they will miss their 2021 production guidance.

They will miss their nickel goal by approximately 35kt, copper goal by 65kt and platinum groups metals by 22t (approximately 710koz).

In the interview, Martin Turenne, CEO of $FPX Nickel Corp. and I cover a few topics:

- Who is Nornickel?

- Will Nornickel’s suspended production affect the nickel market?

- Volkswagen announced that they will begin manufacturing batteries. Turenne’s view on how this will affect the nickel market.

- FPX Nickel announced a $14M bought deal. Turrene gives us a run down on FPX’s plans for the cash.

Disclaimer: The following is not an investment recommendation. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. Junior Stock Review has NO business relationship with FPX Nickel Corp. Brian Leni is a shareholder of FPX Nickel Corp. and therefore biased in his view of the company.