It must be a cold day in hell – the US dollar hit its three-month low, heading for the biggest monthly drop in a year. Looks like shifting interest-rate prospects have turned investors against the buck.

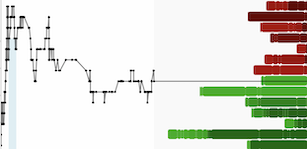

The dollar index, a measure of the currency against six major counterparts, dipped below 102.50 this week, signaling the completion of its third consecutive week of losses. From its peak valuation of 107.36 in 2023, the DXY has shed approximately 3.5%, now hovering around 103.30.

The waning interest in the US dollar has been evident for some time, driven by a growing belief among investors that the US Federal Reserve is poised to cut interest rates by mid-2024. The decline gained momentum following remarks by Christopher Waller, a notably hawkish Federal Reserve policymaker, who hinted at a potential rate cut in the coming months if inflation continues to decelerate.

In a surprising development, inflation dropped more than anticipated to 3.2% last month, compared to the peak of 9.1% in June of the previous year. Despite this, the Federal Reserve has not officially announced any plans for an imminent rate cut. The upcoming Dec. 12 – Dec. 13 meeting is expected to maintain the benchmark rate at 5.25% to 5.50%.

The 10-year yield on US government debt, which moves inversely to price, experienced a 0.04 percentage point decline on Tuesday, reaching 4.35%. This drop echoes levels last witnessed before September's Fed meeting, which triggered a global bond rout by signaling prolonged higher interest rates.

Taking advantage of the weaker dollar, the gold spot price has surged by 1.4% to $2,053 per ounce, reaching its highest level since May. This marks the fourth consecutive gain for gold, emphasizing the inverse relationship between the precious metal and the US dollar.

Investors are turning away from the weakening currency, exploring alternatives such as different currencies, stocks, and gold. The outlook for the USD appears uncertain, prompting caution among market participants.

While the current outlook for the US dollar is shrouded in doubt, it's essential to acknowledge the inherent variability of market conditions. Investors are advised to conduct thorough research and analysis to form informed perspectives. In the dynamic landscape of global finance, opinions may differ, and individuals may find unique opportunities amid the fluctuations in the currency market.