Highlights:

- Abitibi Metals has received results from the Phase II drill program highlighted by the following intervals:

- #338W1 – 4.9% CuEq over 4.0 metres within 2.4% CuEq over 17.5 metres beginning at 1,186.6 metres depth representing an increase in grade relative to the CuEq grade reported in the Company's updated resource

- These intercepts occurred in a lower grade continuous halo of 0.83% CuEq over 77.95 metres

- #338 – 2.1% CuEq over 7.25 metres within 0.86% CuEq over 37.3 metres beginning at 1,206 metres depth

- #338 – 1.7% CuEq over 7.8 metres beginning at 1,261 metres depth

- #338W1 – 4.9% CuEq over 4.0 metres within 2.4% CuEq over 17.5 metres beginning at 1,186.6 metres depth representing an increase in grade relative to the CuEq grade reported in the Company's updated resource

- #338 & #338W1 intercepted a new extensional target 200 metres below historical drilling and beyond the western limit of the B26 deposit, marking a major step in resource expansion potential. The Company is currently planning a downhole EM program to target extensions of this target at depth and identify the potential for a larger nearby source of mineralization.

- Jonathon Deluce, CEO of Abitibi Metals, commented, "We are thrilled with the initial Phase II results, which showcase B26's potential and reveal a new extensional target 200 metres below historical drilling, bolstering our confidence in the project's growth and expansion."

- The Company recently announced an updated resource which included 11.3MT @ 2.13% Cu Eq (Ind) and 7.2MT @ 2.21% Cu Eq (Inf) (See news release dated November 13, 2024)

LONDON, ON, Nov. 19, 2024 /CNW/ - Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) ("Abitibi" or the "Company") is pleased to provide an update on the 16,500-metre Phase II drill program at the B26 Polymetallic Deposit ("B26", the "Project" or the "Deposit") that is currently underway. Abitibi Metals is fully funded with $13.0 million to complete the remaining 2024 work program and an additional 20,000 metres in 2025, which will be incorporated into a Preliminary Economic Assessment to complete the option. On November 16th, 2023, the Company entered into an option agreement on the B26 Deposit to earn 80% over 7 years from SOQUEM Inc (see news release dated November 16, 2023).

The previously identified broad zone of mineralization from 1,206 to 1,344 metres in step out hole 1274-24-338 returned 0.85% CuEq over 37.3 metres, starting at 1,206.3 metres. The mineralized interval contains two high grade intervals of 2.0% CuEq over 3.7 metres and 2.1% CuEq over 7.25 metres starting at 1,206.25 and 1,220.85 metres, respectively. Locally gold is present at an average grade of 1.46 g/t Au from 1,206.25 to 1,209.95 metres. True thickness is approximately 70% and 80% of core length. These results confirm the continuity of the chalcopyrite bearing veins outside the current resource envelope and outline the interpreted plunge of the mineralized system at a deposit scale.

The wedge hole (1274-24-338W1), branched out from the original hole to intercept the mineralized zone approximately 50 metres above the highlight intercept in hole 1274-24-338. The wedge intersected the same high-grade zone, which includes 2.4% CuEq over 17.5 metres, starting at 1,186.6 metres, including a shorter interval of 4.9% CuEq over 4.0 metres, demonstrating the high-grade potential of the B26 zone down dip.

The new exploration area is located approximately 200 metres below historical drilling and outside the western limit of the B26 Deposit. Management considers the expansion of the down dip target a breakthrough that supports the modelling of a structurally controlled gold bearing quartz veining system with chalcopyrite. Once combined with disseminated low grade material, the overall mineralized system reaches an average thickness of 140 metres.

Jonathon Deluce, CEO of Abitibi Metals, commented, "We are thrilled with the initial Phase II results, which showcase B26's potential and reveal a new extensional target 200 metres below historical drilling, bolstering our confidence in the project's growth and expansion. Overall, these intercepts confirm the continuity of high-grade zones and new areas of mineralization beyond the existing resource boundary, underscoring the potential to continue adding to our significant underground resource of over 18 million tonnes. We plan to continue growing our contained metal inventory with more strategic drilling to further deliver value for our shareholders."

Abitibi Metals continues to progress on its Phase II, 16,500 metres drill program at the B26 Deposit, having completed 16 holes (12,331 metres) to date. The Company is awaiting results from the 10,339 metres drill program at the B26 Deposit.

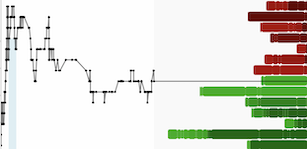

Table 1: Significant Intercepts

Hole ID | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Zn (%) | ||||||||

1274-24-338 | 1206.25 | 1243.5 | 37.25 | 0.85 | 0.72 | 0.18 | 1.84 | 0.01 | ||||||||

Including | 1206.25 | 1209.95 | 3.7 | 2.01 | 1.03 | 1.46 | 2.87 |

0.01 | ||||||||

Including | 1220.85 | 1228.1 | 7.25 | 2.12 | 2.04 | 0.07 | 3.56 | 0.01 | ||||||||

And | 1261.75 | 1269.5 | 7.75 | 1.66 | 1.37 | 0.39 | 3.77 | 0.01 | ||||||||

And | 1275.7 | 1279.75 | 4.05 | 1.07 | 0.86 | 0.29 | 2.55 | 0.01 | ||||||||

And | 1331.4 | 1341 | 9.6 | 0.82 | 0.24 | 0.11 | 12.94 | 1.13 | ||||||||

1274-24-338W1 | 1159.55 | 1237.5 | 77.95 | 0.83 | 0.73 | 0.13 | 1.82 | 0.02 | ||||||||

Including | 1186.6 | 1204.1 | 17.5 | 2.38 | 2.10 | 0.37 | 4.19 | 0.01 | ||||||||

Including | 1189.3 | 1193.3 | 4 | 4.88 | 4.66 | 0.24 | 8.31 | 0.01 | ||||||||

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 70 to 80% of the mineralized lens' true width. Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90% for gold, 96.1% for zinc, 72.1% for silver. Note 3: Intervals were calculated using a cutoff grade of 0.1% Cu Eq, which represents the visual limit of the mineralized system. | ||||||||||||||||

Table 2: Drill Hole Information | ||||||||||||||||

Drill hole | Target | UTM East | UTM North | Elevation | Azimuth | Dip | Length (m) Drilled | |||||||||

1274-24-338 | Western Plunge | 652368 | 5513881 | 276 | 200 | -77 | 1,422 | |||||||||

1274-24-338W1 | Western Plunge | 652368 | 5513881 | 276 | 171.1 | -56.24 | Wedge Start – 900m Depth – 1,500 | |||||||||

The core logging program was run by Explo-Logik in Val d'Or, Quebec. The drill core was split with half sent to AGAT Laboratories Ltd. and prepared in Val d'Or, Quebec. All samples are processed by fire assays on 50 gr with atomic absorption finish and by "four acids digestion" with ICP-OES finish, respectively, for gold and base metals. Samples returning a gold grade above 3 g/t are reprocessed by metallic screening with a cut at 106 µm. Material treated is split and assayed by fire assay with ICP-OES finish to extinction. A separate split is taken to assay separately mineralized intervals with target grades above 0.5% Cu using Na2O2 fusion and ICP-OES or ICP-MS finish. Samples preparation duplicates, varied standards, and blanks are inserted into the sample stream.

In the 2018 resource estimate, SGS recommended the QAQC protocol to explain the replicability for the four metals (Au-Cu-Ag-Zn). The Company has set up for this program a series of assaying protocols with the objective to control QAQC issues from the beginning of the project. As a result, samples are crushed finer with 95% of particles passing 1.7 mm and a large split of 1 kg is pulverized down to 106 µm (150 mesh). Other measures put in place include the automatic re-assaying of gold results above 3 g/t by metallic screening and the use of sodium peroxide fusion in mineralized intervals interval corresponding to a target grade above 0.5% Cu.

Qualified Person

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi's portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate of 11.3MT @ 2.13% Cu Eq (Ind) & 7.2MT @ 2.21% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec's mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release. |

Note 1: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90% for gold, 96.1% for zinc, 72.1% for silver.

Forward-looking statement:

This news release contains certain statements, which may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company's behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi's forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects," "estimates," "anticipates," or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results "may," "could," "might" or "occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.

SOURCE Abitibi Metals Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/19/c5975.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/19/c5975.html